TVC Meet Day!

Eastern Elementary Families,

This is a reminder that we are currently in the middle of this year’s Kids Heart Challenge benefiting the American Heart Association.

Please make sure all donations are turned in by Monday, February 23rd. We will celebrate our students’ efforts on Friday, February 27th in the elementary school gym.

If your child has not yet registered, you can do so by visiting the American Heart Association website at heart.org.

Thank you for helping make this event such a success. We appreciate your continued support of our students and school community!

Congratulations to our Varsity Lady Eagles Basketball Team for their victory against Parkersburg South this evening!

The Meigs County Food Pantry will have their monthly distribution Thursday the 19th of February from 4:00-6:00 PM or until supplies run out at the Meigs Local Administrative offices.

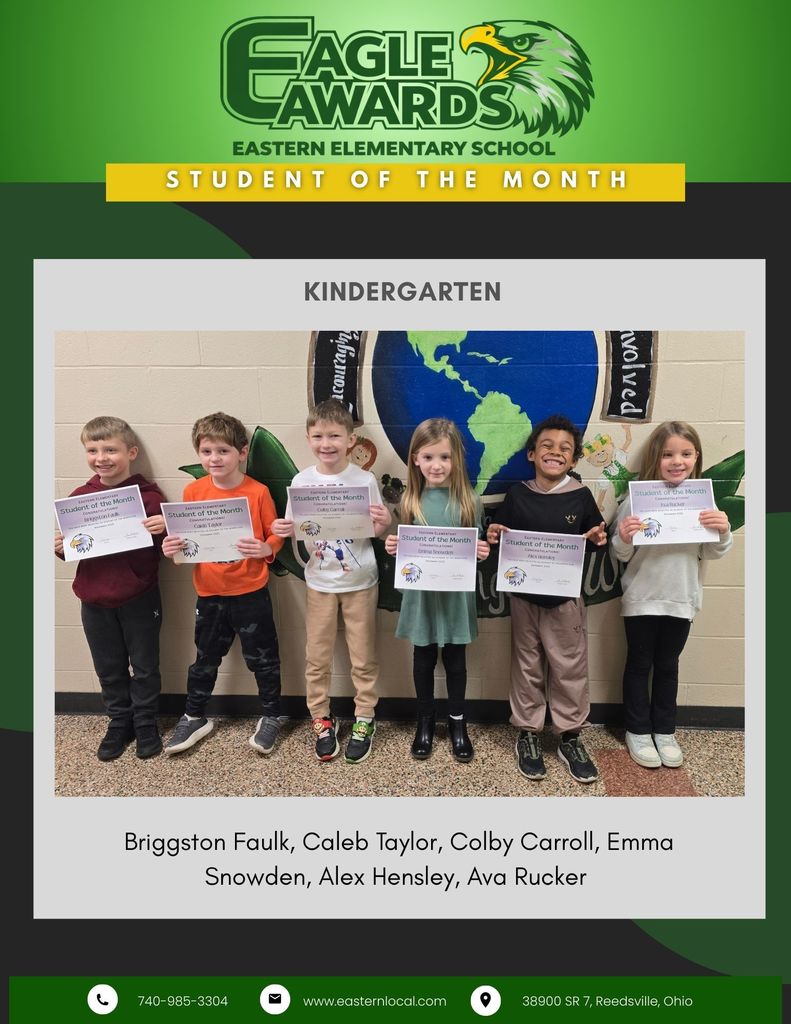

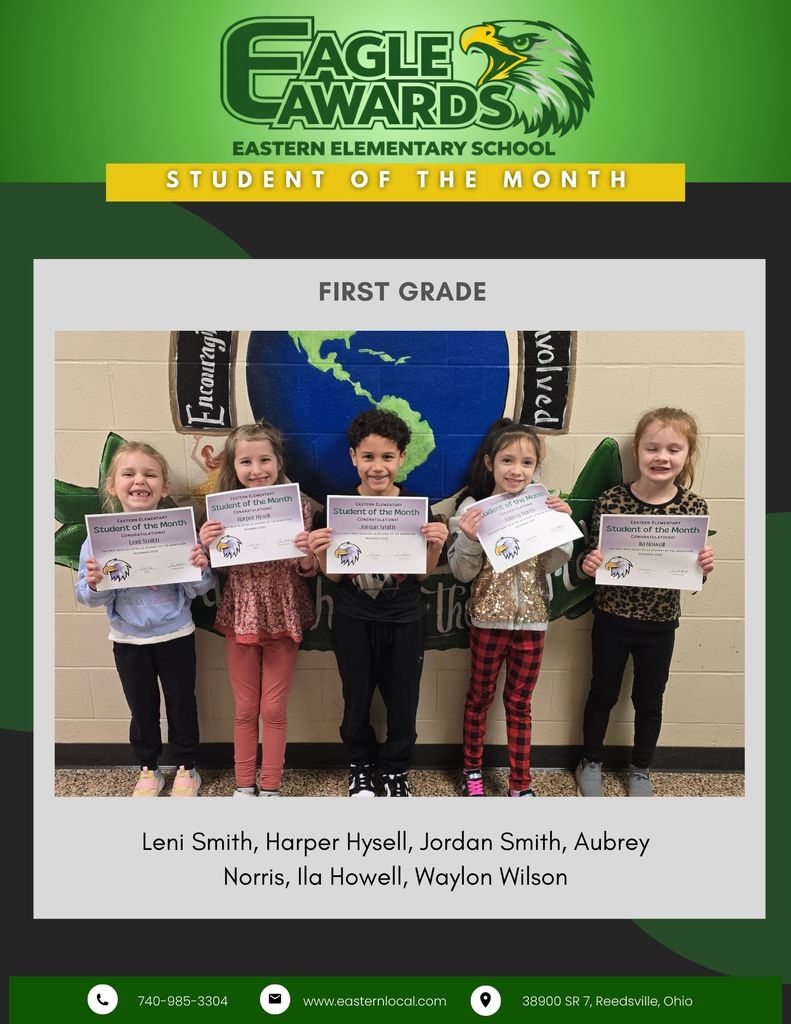

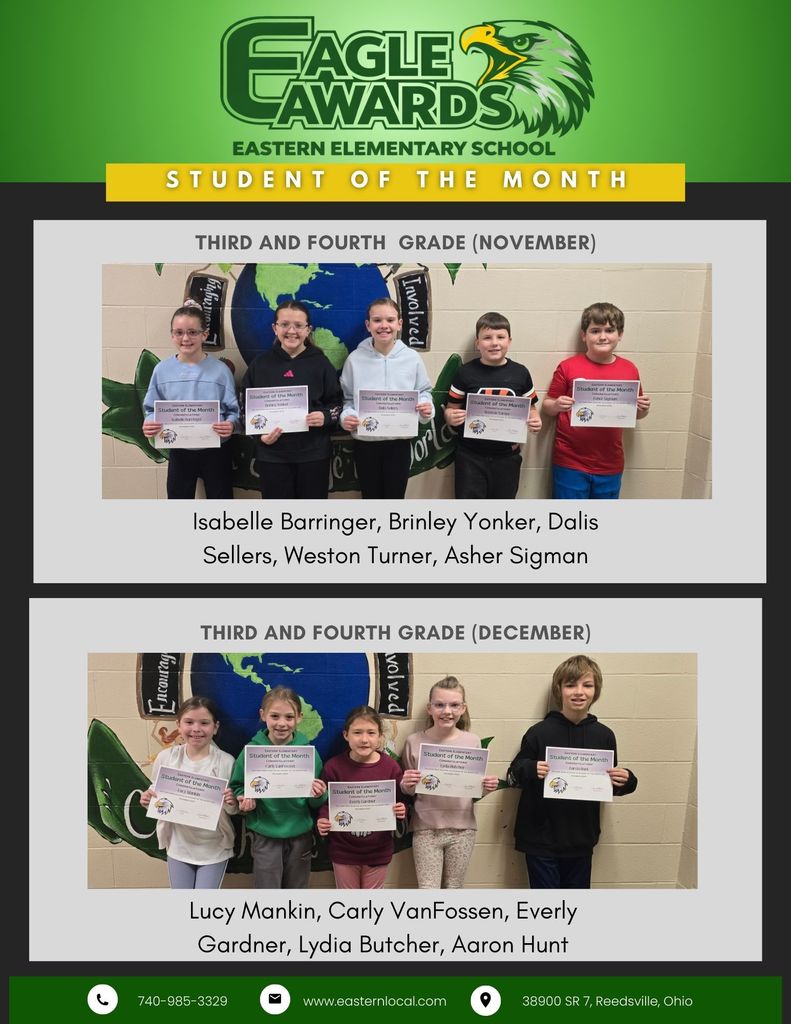

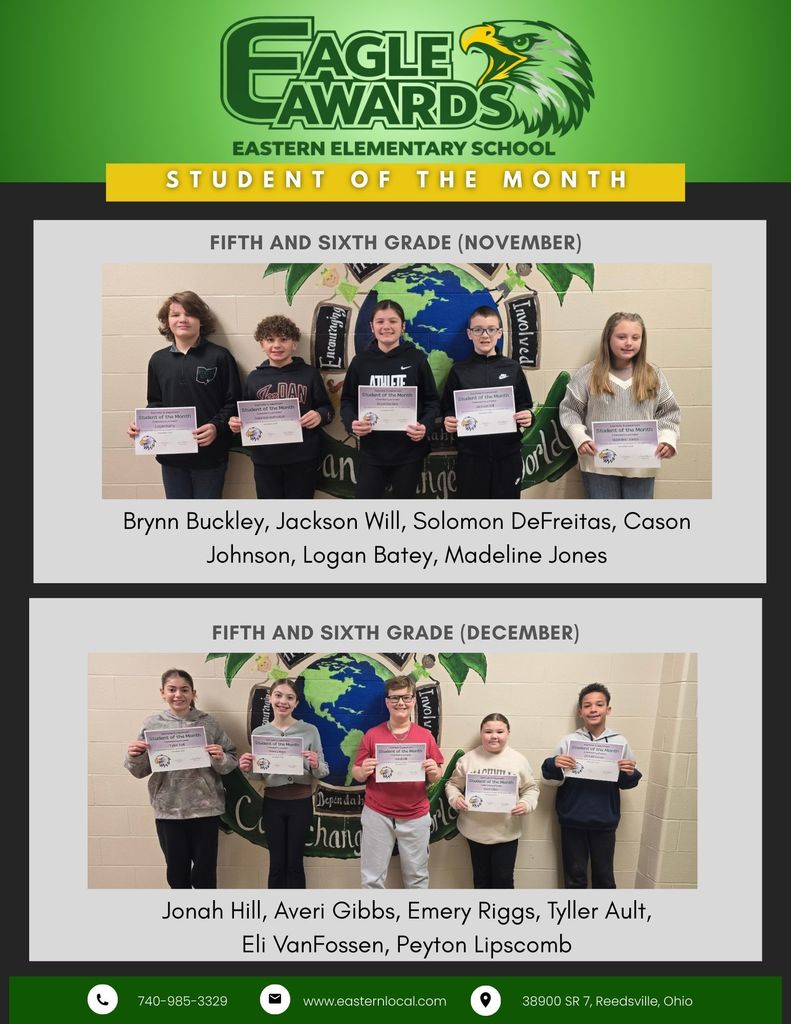

Eastern Elementary is proud to announce our Student of The Month Winners for November and December! Congratulations! These students were recognized during our January Awards Assembly!

Congratulations to our Eastern Elementary Academic Awards Recipients for the 2nd Nine Weeks!

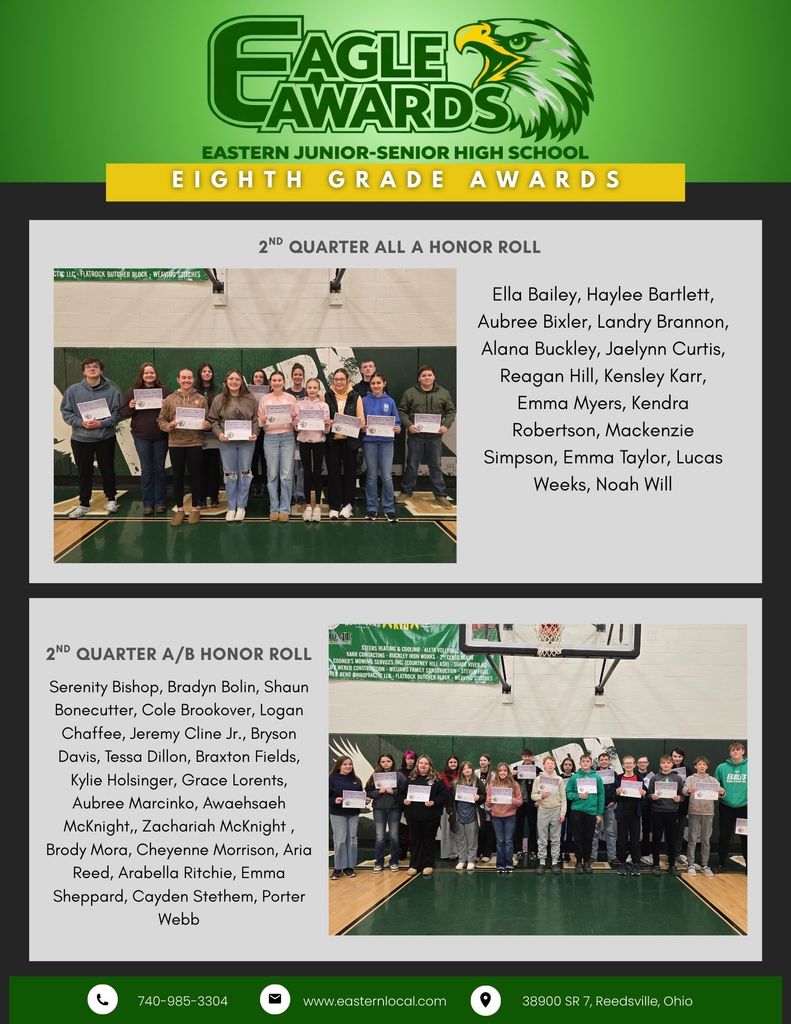

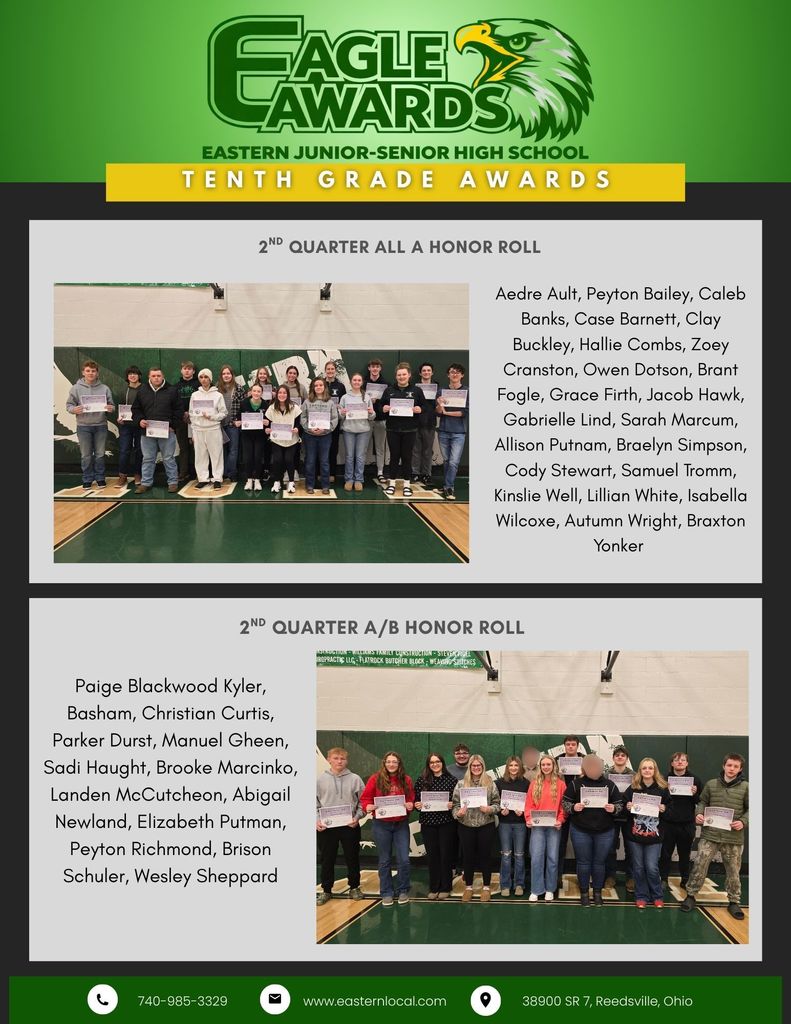

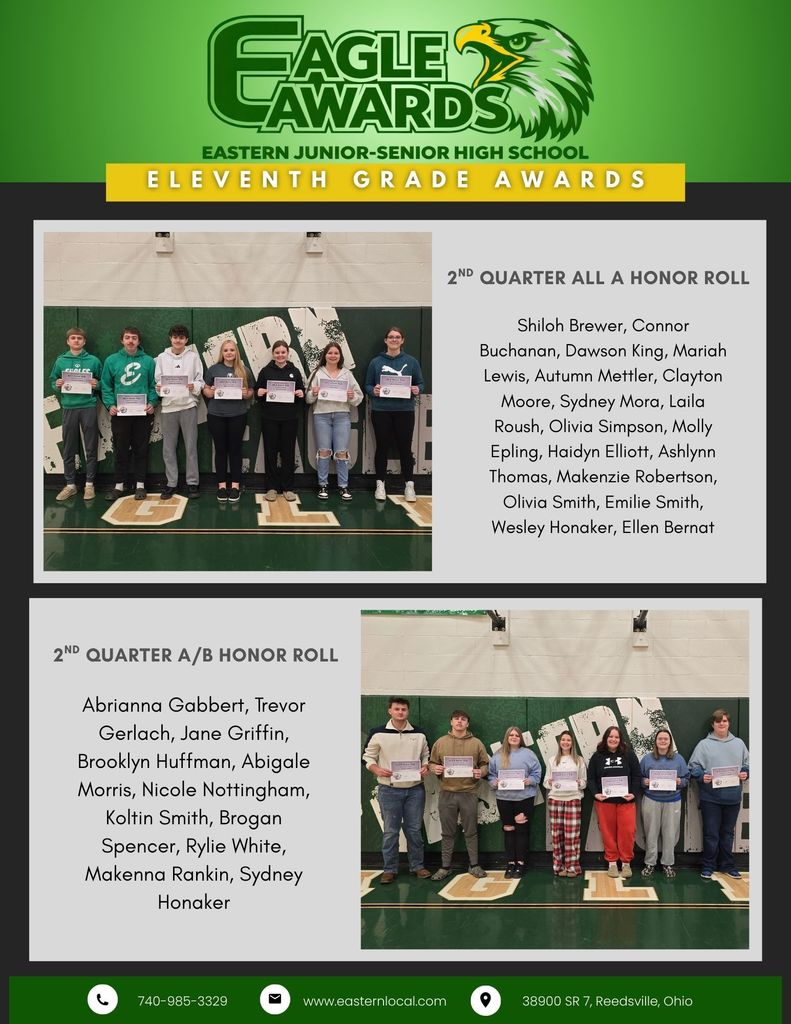

Congratulations to our Eastern Junior High and High School - 2nd Nine Weeks Academic Awards Winners!

The Lady Eagles are your TVC Champs!

Game Day!

Varsity Girls Basketball has picked up a game at Parkersburg South on Wednesday 2/18 at 6:00pm.

Athletics Schedule for 2/15-21

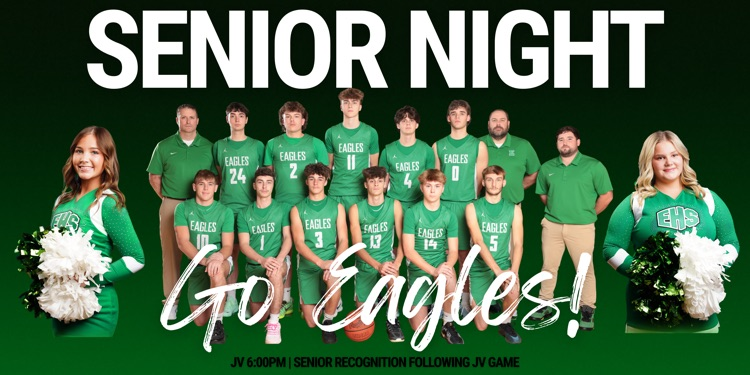

The Eagles fell just short, but we had a great time celebrating our basketball and cheer seniors! Thank you to everyone who came out and showed your support!

Thank you to Mr. Jeremy Fisher, candidate for Meigs County Probate Judge, for sponsoring tonight's game ball!

Go Eagles!

Game Day!

Eastern Athletics and Boys Basketball would like to thank our two separate game ball sponsors this evening.

Jeremy Fisher, candidate for Meigs County Probate Judge.

Rich Wamsley, candidate for Meigs County Commissioner.

Game Day!

This is an additional reminder that all Washington State In-Cert Students and Meigs Vocational students are to report to school as regularly scheduled for off campus learning. Transportation will be provided as usual.

Hello, This is a reminder that Parent Teacher Conferences are this evening from 3:30-6:30pm, and their is no school for students Friday February 13th and Monday, February 16th. Additionally, this is a reminder that we will be hosting our mandatory senior graduation meeting on Tuesday February 17th from 6-6:30 in the high school cafeteria. Thank you!

Tonight's Girls Basketball game vs. Meigs has been canceled.

Eastern Sophomore Career Coaching has been rescheduled for Tuesday, February 17th during the school day. This is based on initial Career Navigation Testing completed earlier on in the year, and helps educate students about a variety of career pathways that align with interest and skill.

Eastern Local will be on a regular schedule with plan B bus routes Thursday February 12th